How to Get (Almost) Free Tick Data

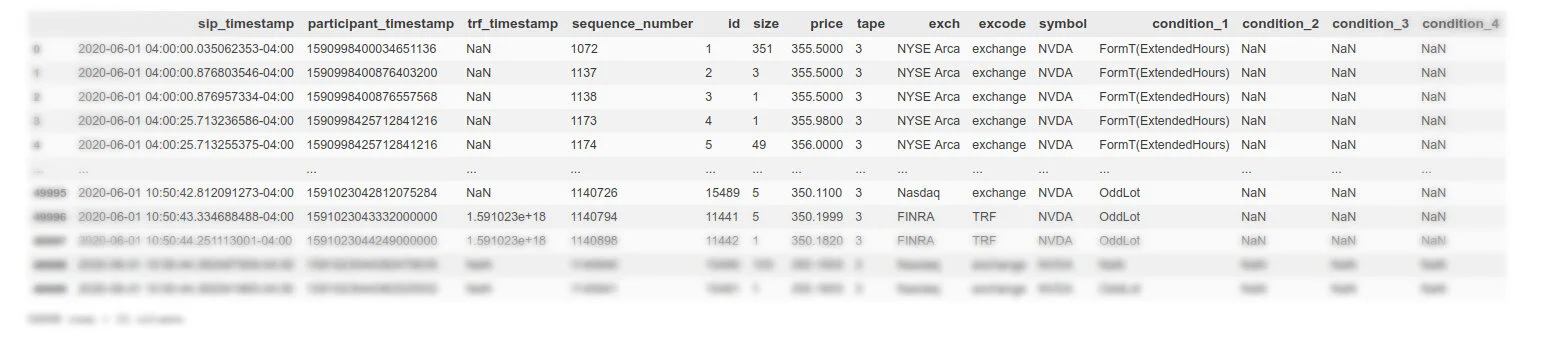

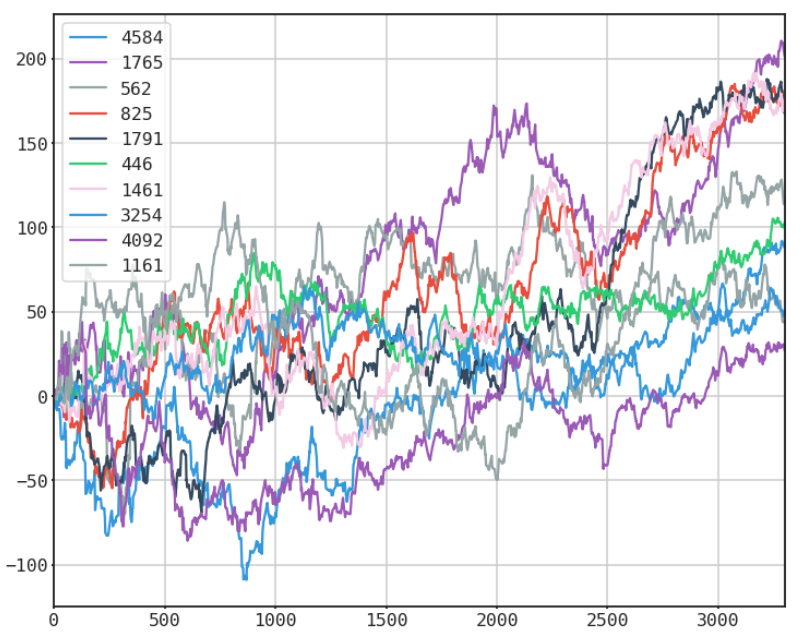

/Access to high quality, cost effective market data is a continuing problem for retail traders. I was recently told about the ongoing efforts of the startup brokerage “Alpaca”. The gentleman I spoke with said the API gave access to the tick data of thousands of stocks everyday and without cost.

I thought it was too good to be true but recently I took a little bit of time to investigate.

Read More