A Dead Simple 2-Asset Portfolio that Crushes the S&P500 (Part 1)

/I'm going to share a portfolio with you that has absolutely annihilated the performance of the market (as proxied by SPY) since the recovery began in 2009*. The strategy has not had a down year since. This portfolio maintains constant exposure, has 1 un-optimized parameter and wins on a risk-adjusted basis even after considering reasonable transaction costs.

I can't claim credit for the general idea. I found it in the comments section while reading a SeekingAlpha article written by Jonathan Kinlay titled "Investing in Leveraged ETFs - Theory And Practice". An astute commenter named Varan suggested it. It was so intriguing I set out to replicate the strategy using the Quantopian platform. Before I explain why the strategy works, and how it can be defeated, I'll post some of the strategy performance statistics.

Impressive for such a simple strategy. Some notable points:

- The strategy meets almost** all of the requirements of the Quantopian Managers Program which selects the highest performing algorithms for its fund. The following shows the strategy vs Quantopian's threshold requirements.

- Annual Return 34% > 7%

- Annual Volatility 24% < 30%

- Sharpe Ratio 1.35 > 0.6

- Max Drawdown 23% < 30%

- Calmar ratio 1.48 > 0.5

- Stability of Returns .98 > 0.5

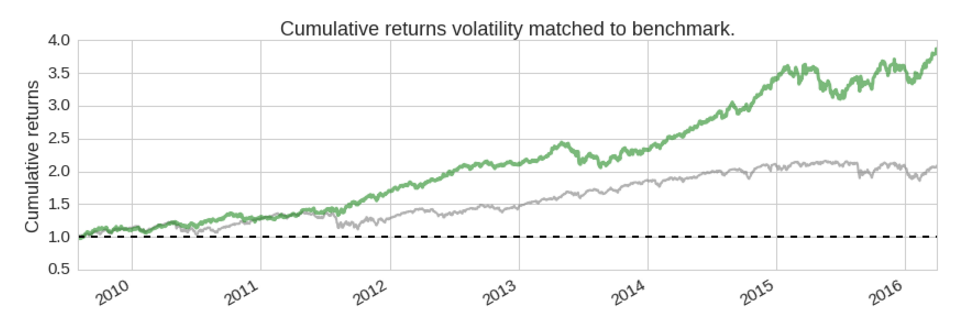

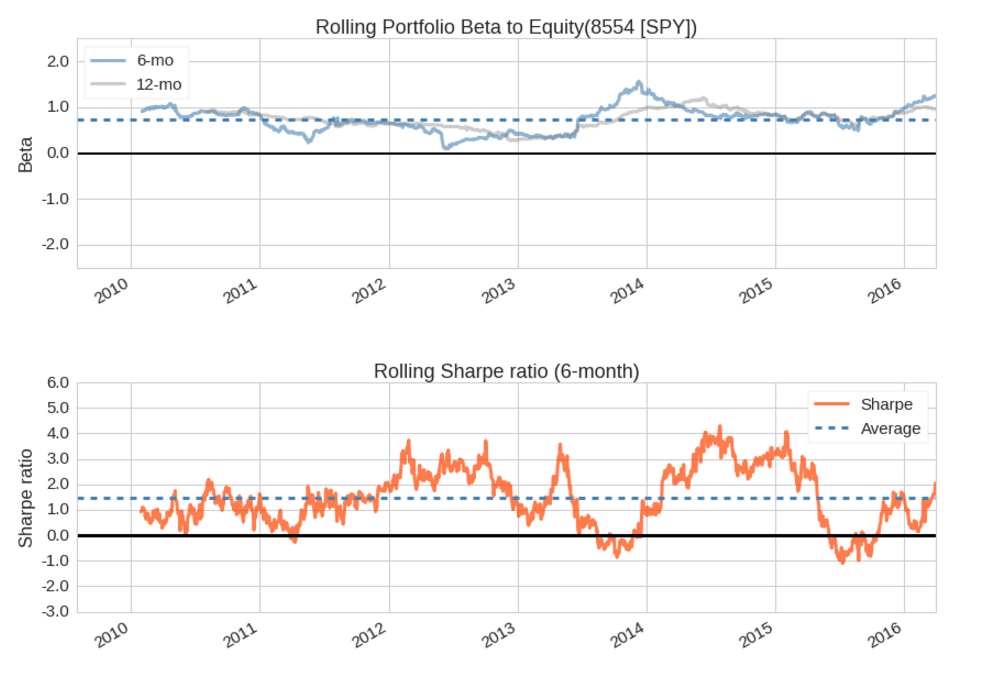

- The volatility equalized equity curve crushes SPY. The strategy doesn't take on excessive risk or beta as demonstrated by the rolling beta and Sharpe ratio plots.

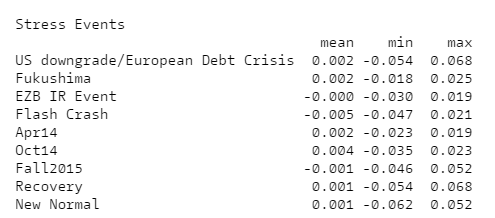

- The strategy had positive mean returns during 6/9 (67%) of the stress events identified by Quantopian over the period of analysis.

- Equally impressive are the annual returns and distribution of annual returns. The strategy has not lost money on annual basis and the mean of the returns are distinctly positive and skew to the right.

I can hear you asking "What is the strategy?".

The Strategy:

- Select the following two 3x leveraged ETFs:

- UPRO - ProShares UltraPro S&P 500 Index Fund

- TMF - Direxion 30-Year Treasury Bull 3X - Triple-Leveraged ETF

- Select a lookback period. I used 63 days. I did not optimize the lookback.

- Calculate each security's volatility over the lookback period.

- Determine the investment allocation weights using a risk-parity framework. Essentially each asset's weight is inversely proportional to its volatility i.e., assets with higher volatility will be assigned a lower weight and vice versa.

- Rebalance weekly.

Part 2 of this post will examine why the strategy works and the specific situations in which the strategy will fail.

*Both TMF and UPRO didn't start trading until Q2 and Q3 of 2009 respectively. **Quantopian does not allow leveraged ETF strategies for its fund since I last checked. Additionally the strategy beta has to remain within a band of +/- 0.30. This strategy had an average beta of 0.75.