COMPOSITE MACRO ETF WEEKLY ANALYTICS (2/27/2016)

/FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

LAYOUT (Organized by Time Period):

Notable Trends and Observations

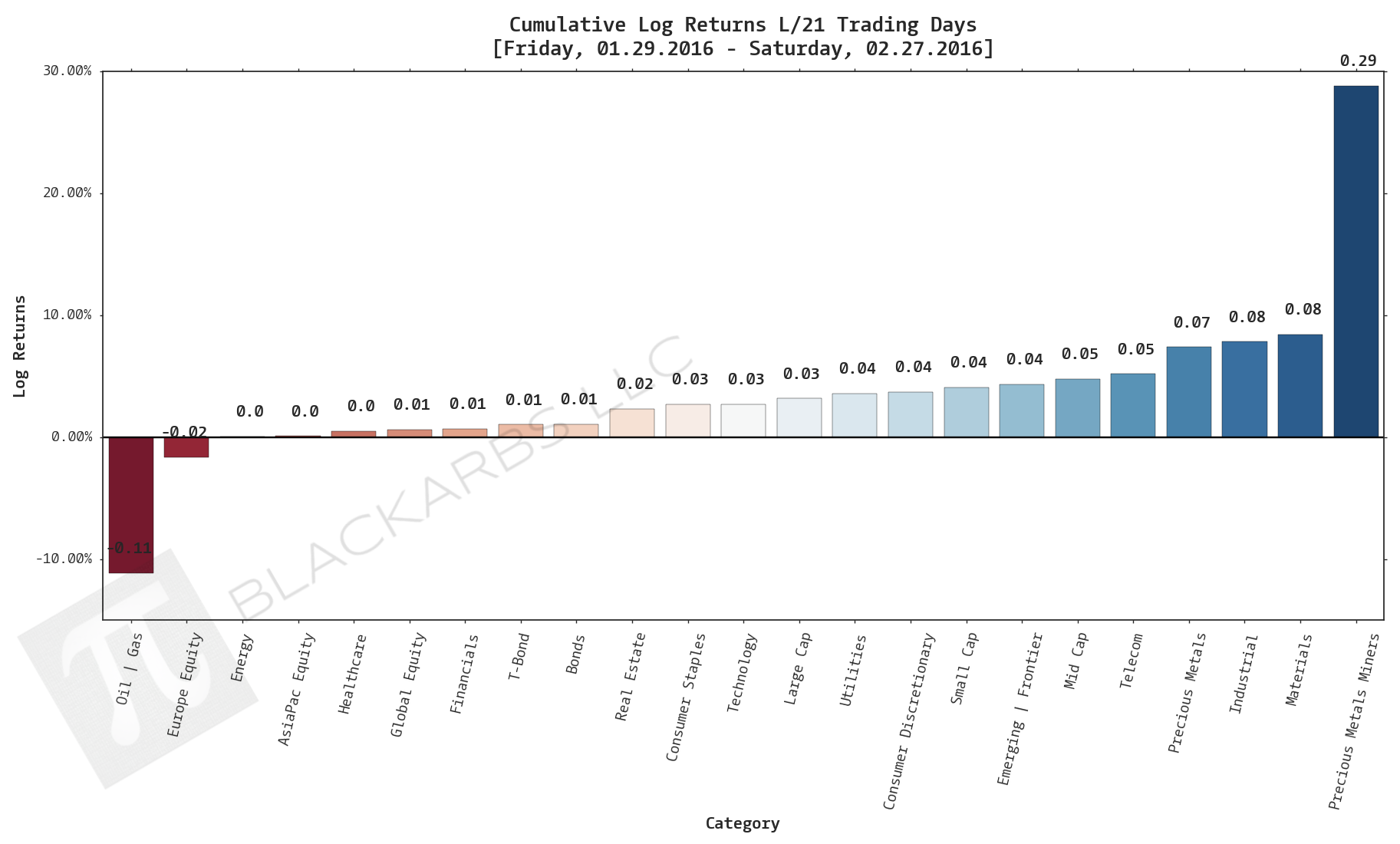

Composite ETF Cumulative Returns Momentum Bar plot

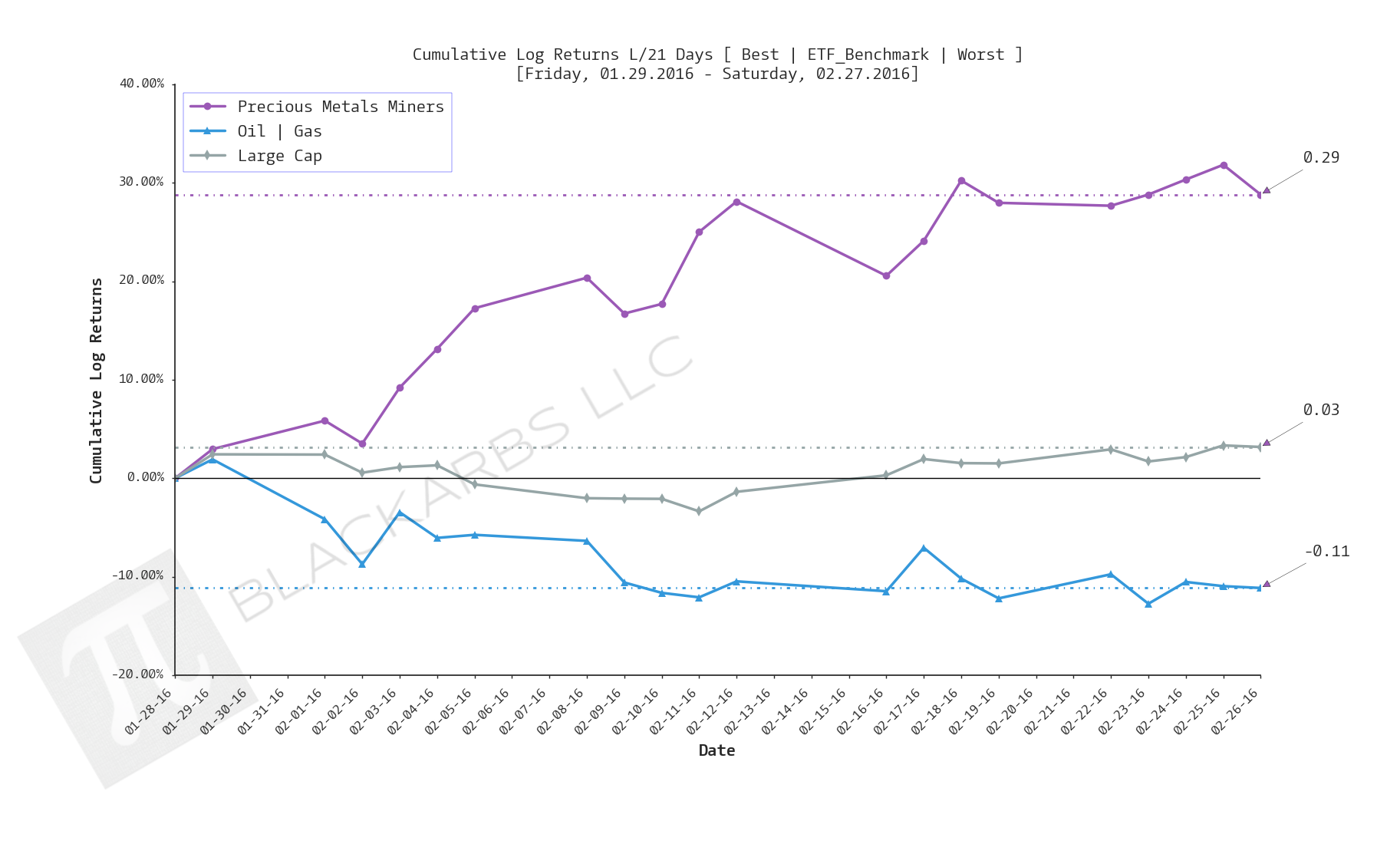

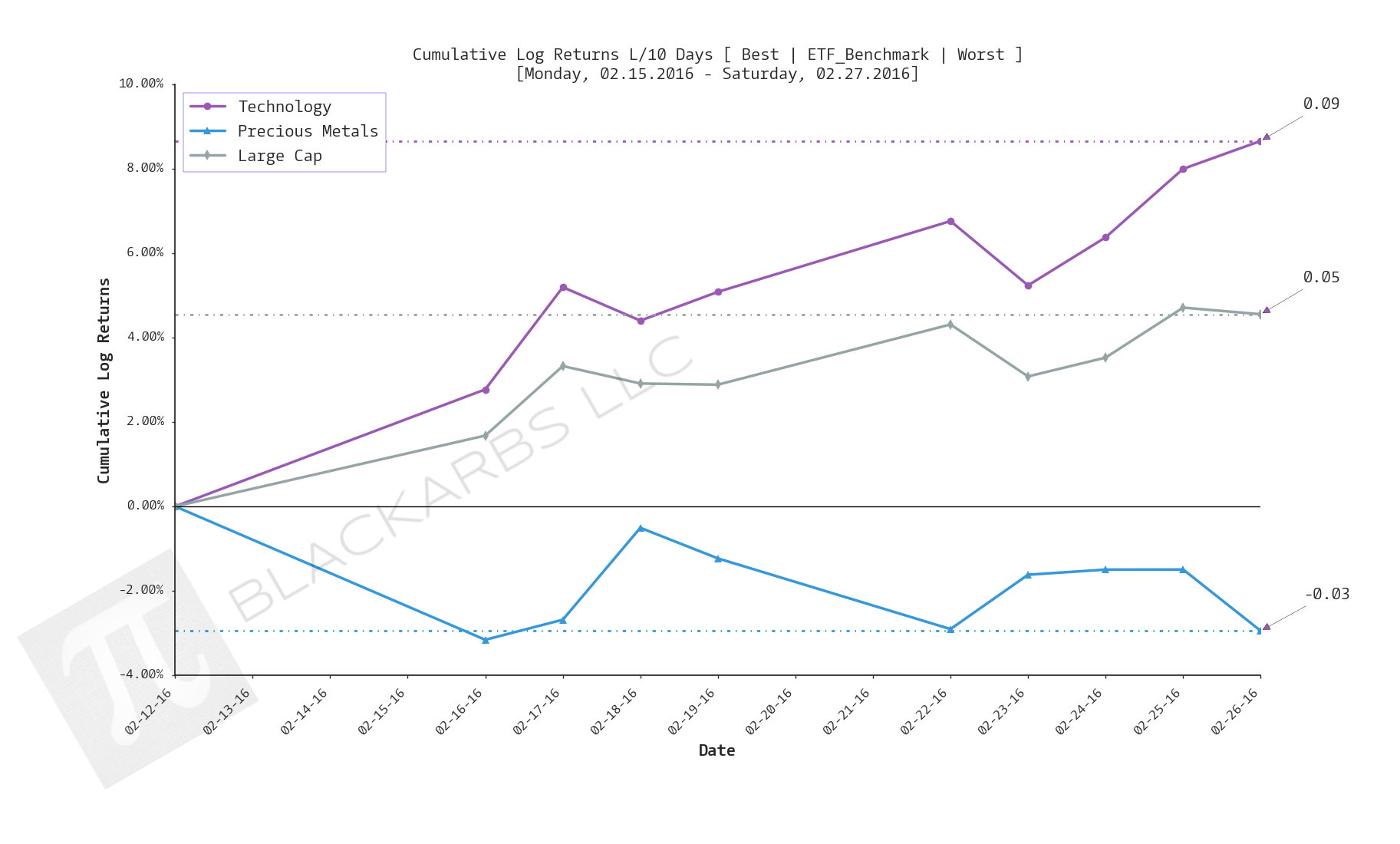

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

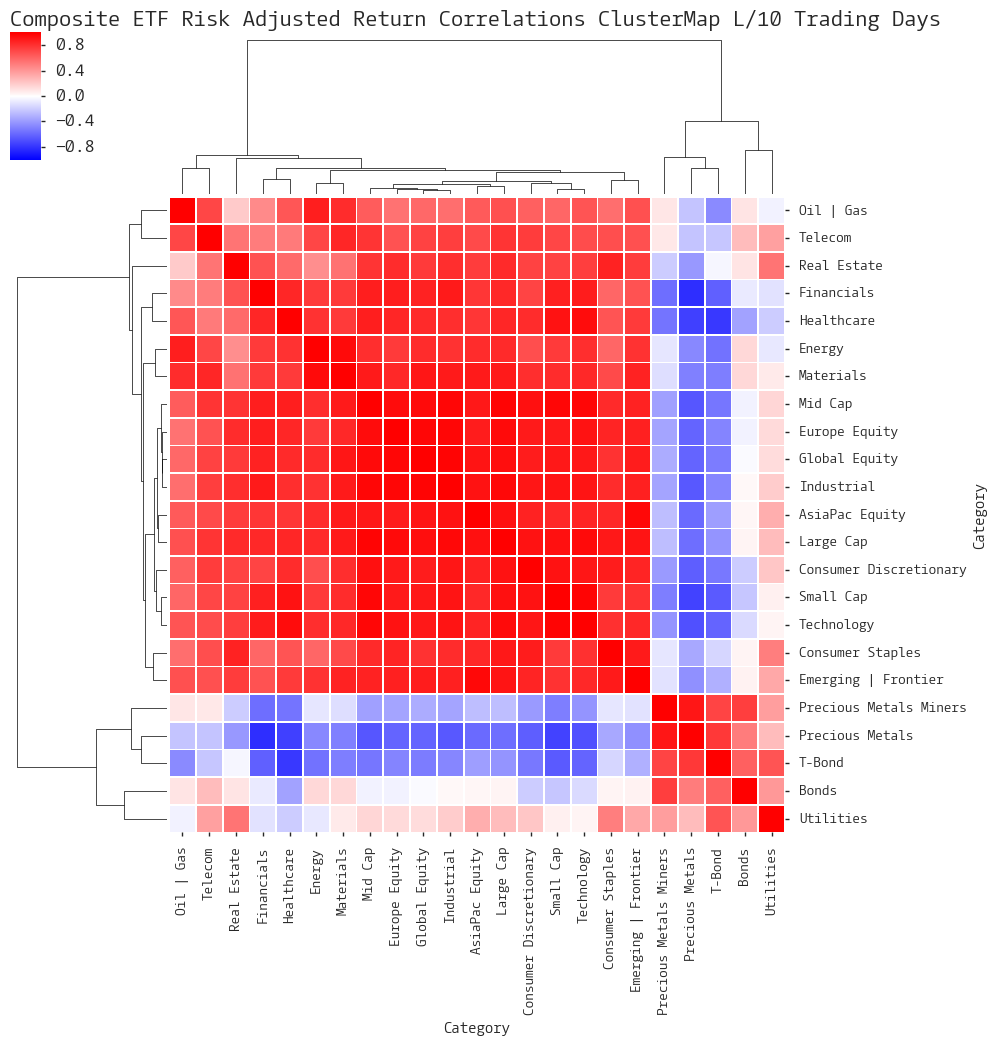

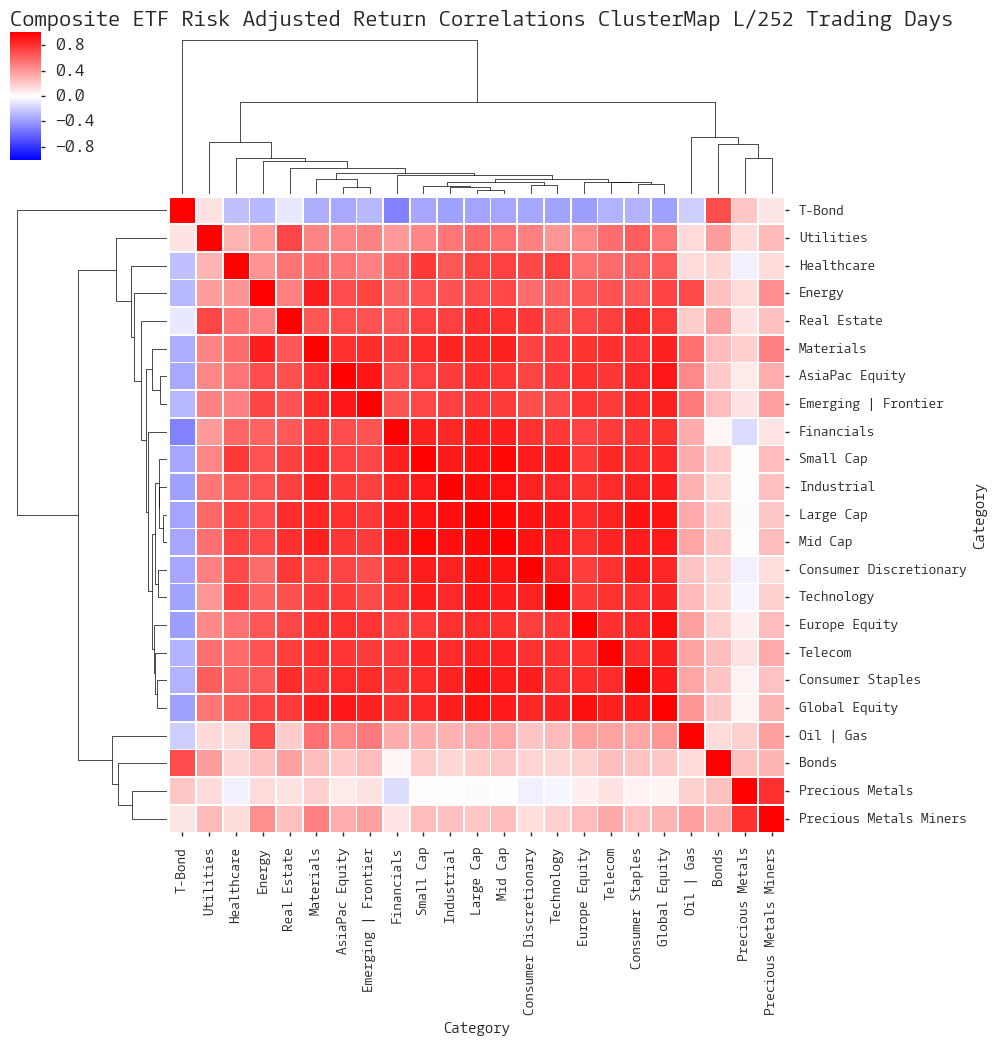

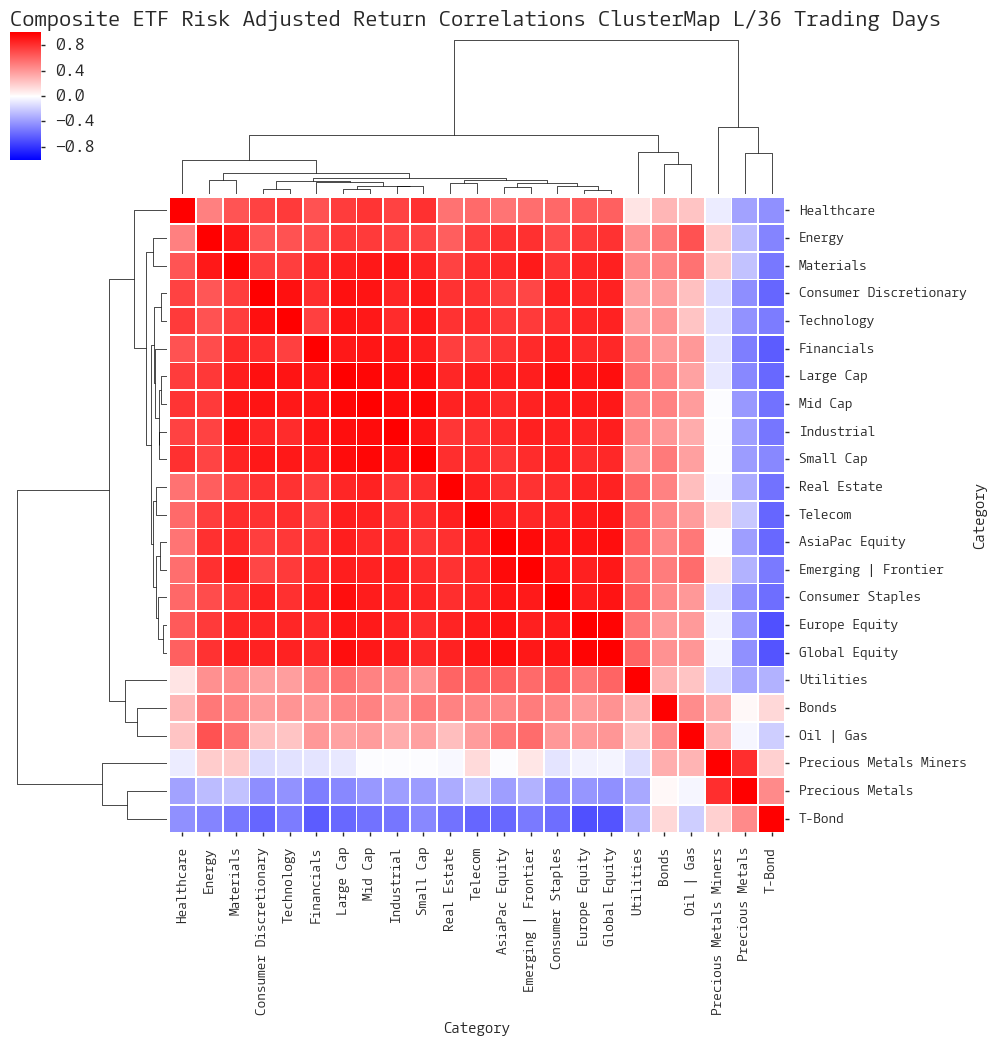

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Implied Cost of Capital Estimates

Composite ETF Cumulative Return Tables

COMPOSITE ETF COMPONENTS:

Notable Observations and Trends:

- Cumulative returns across a broad spectrum of composites remain weak evidenced by only Utilities and Treasuries showing gains over the last 252 days.

- Mid January appears to be a major turning point/trend change for the Precious Metals Miners composite. Looking at the last 126 days Best/Worst plot shows a sharp V bounce which has continued since.

- Investors positioning still looks defensive over the longer frames of 252, 126, 63 days as evidenced by the outperformance of the Precious Metals complex, Utilities, and Treasuries.

- The market overall still looks binary (risk-on/risk-off) as evidenced by the increase in inverse correlations across timeframes between risk assets (sectors, global, emerging equity) and defensive assets (precious metals, bonds, utilities, telecom) .

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

YEAR-TO-DATE LAST 41 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Implied Cost of Capital Estimates:

To learn more about the Implied Cost of Capital see here.