COMPOSITE MACRO ETF WEEKLY ANALYTICS (2/13/2016)

/FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

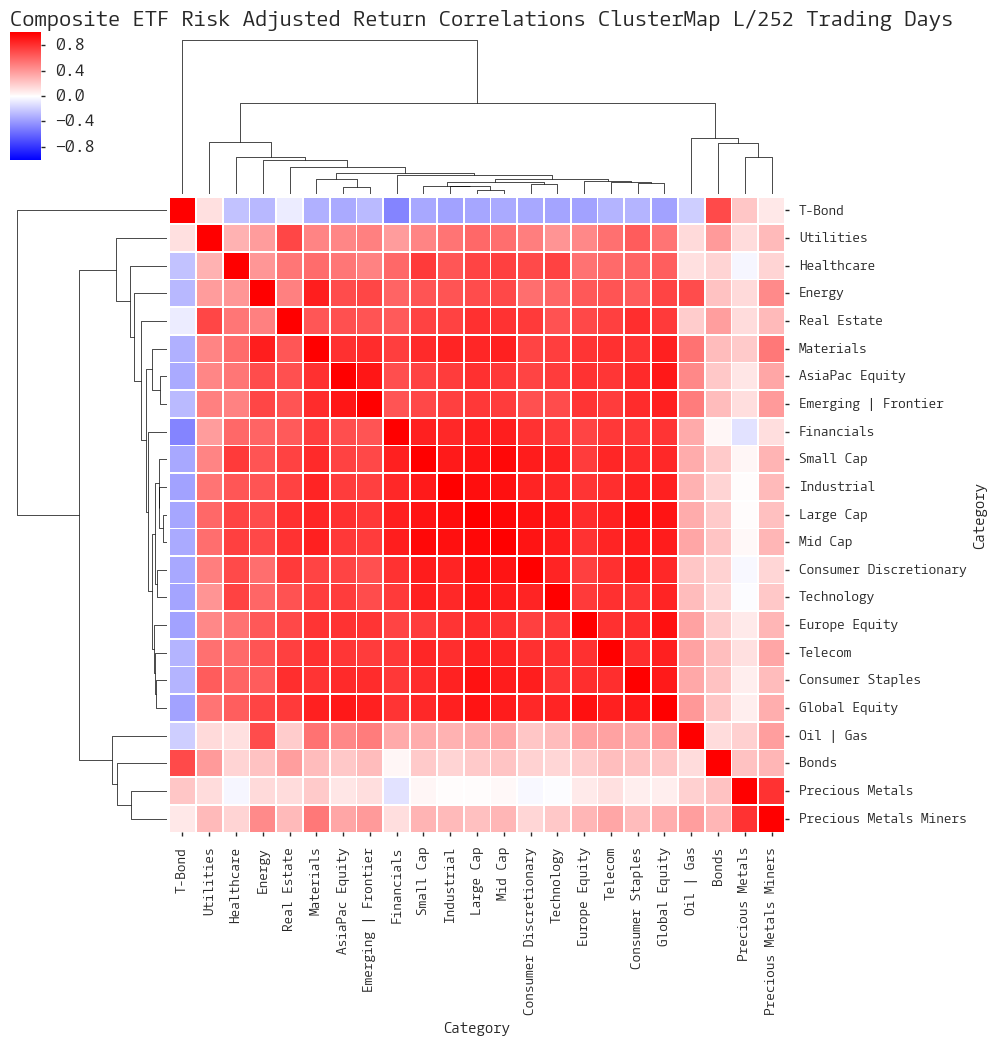

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Implied Cost of Capital Estimates

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

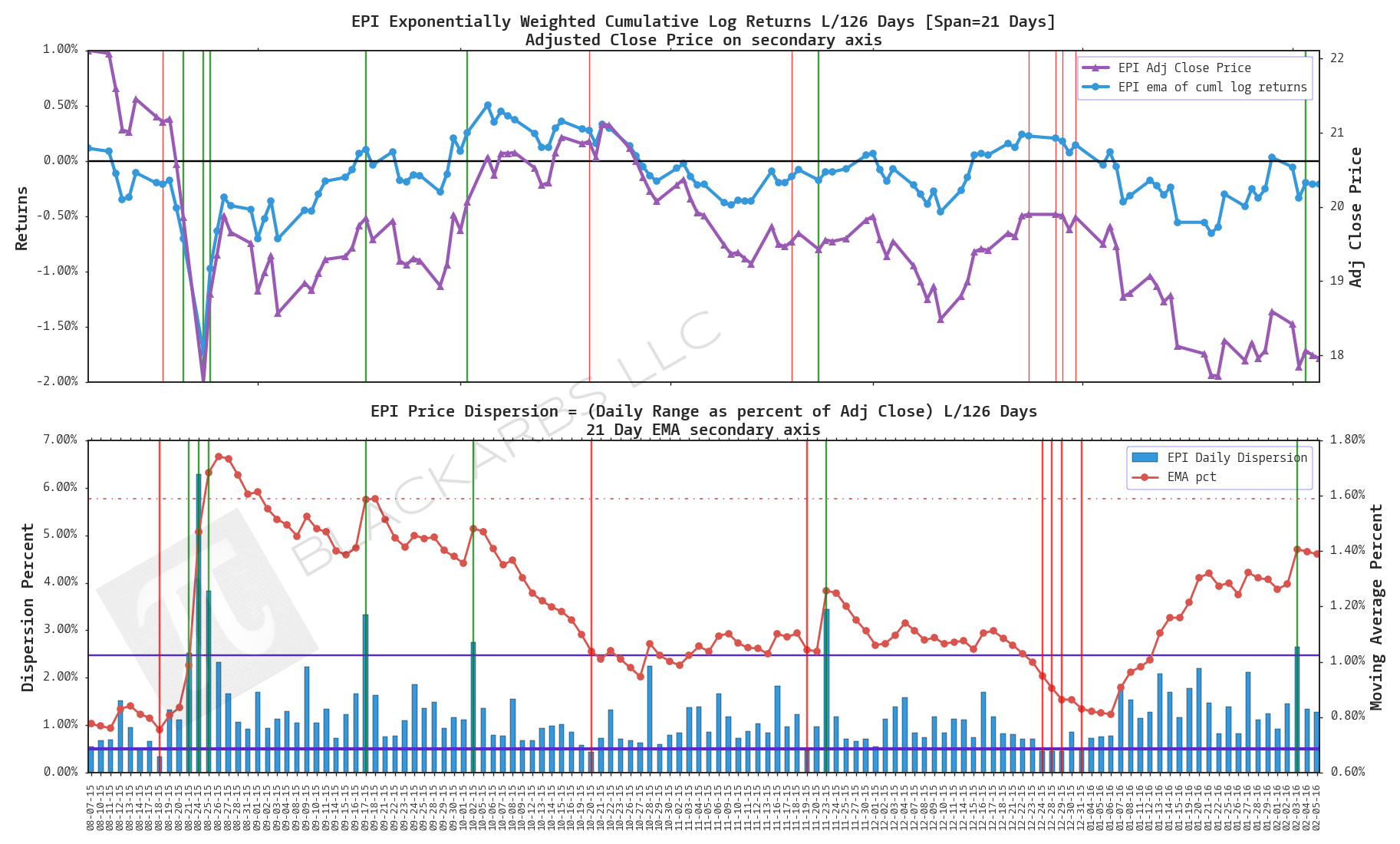

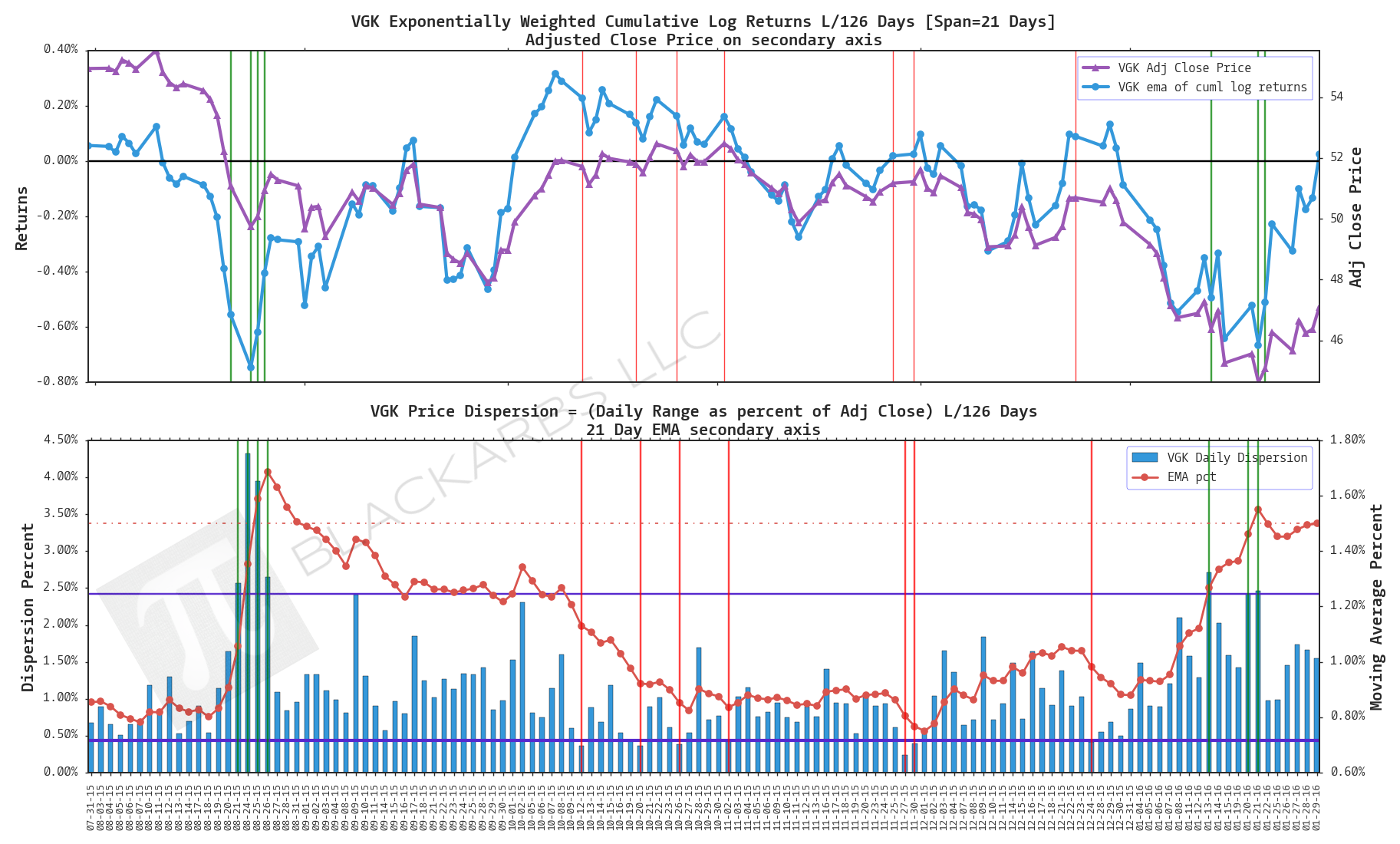

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

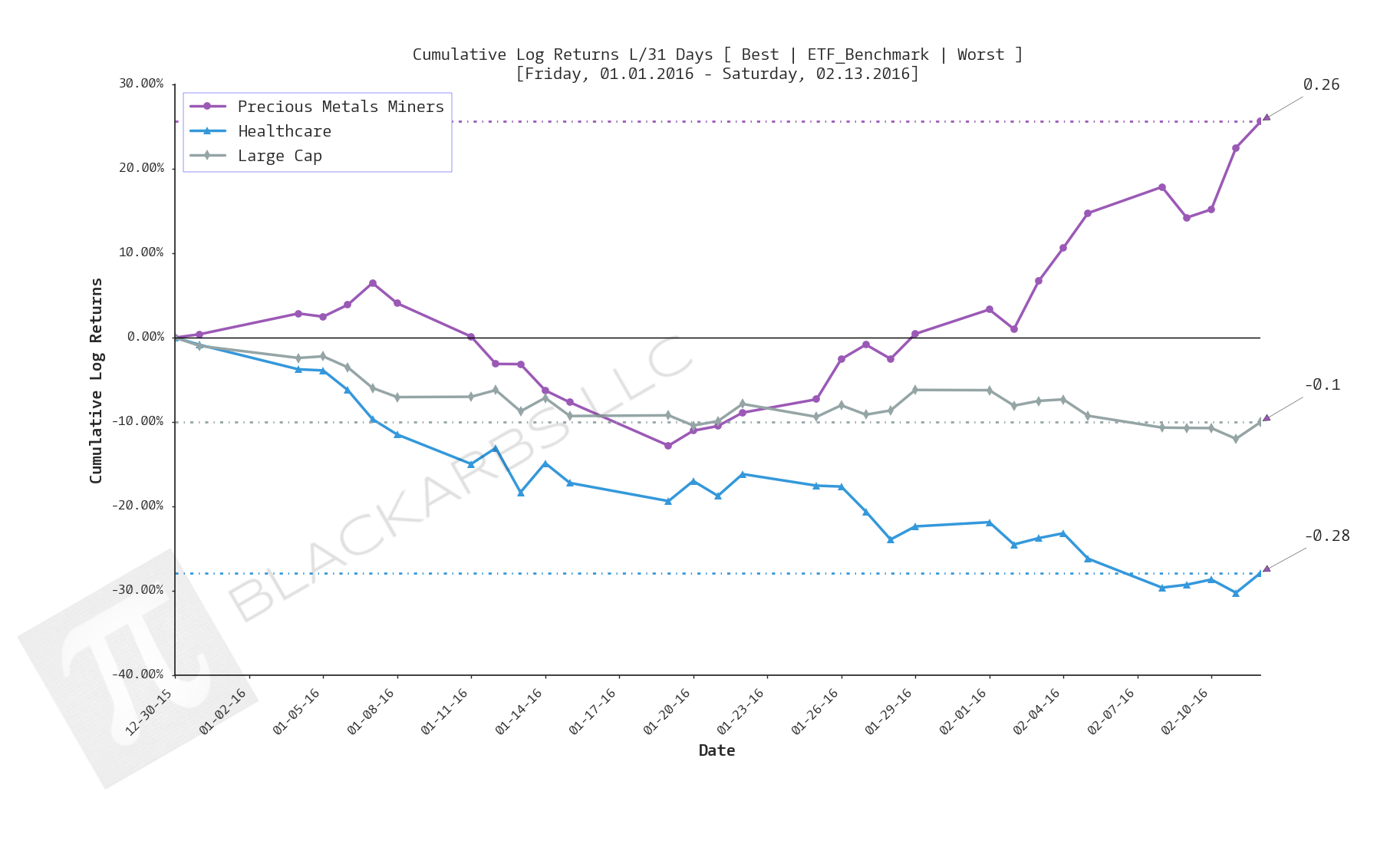

year-to-date LAST 31 TRADING DAYS

LAST 21 TRADING DAYS

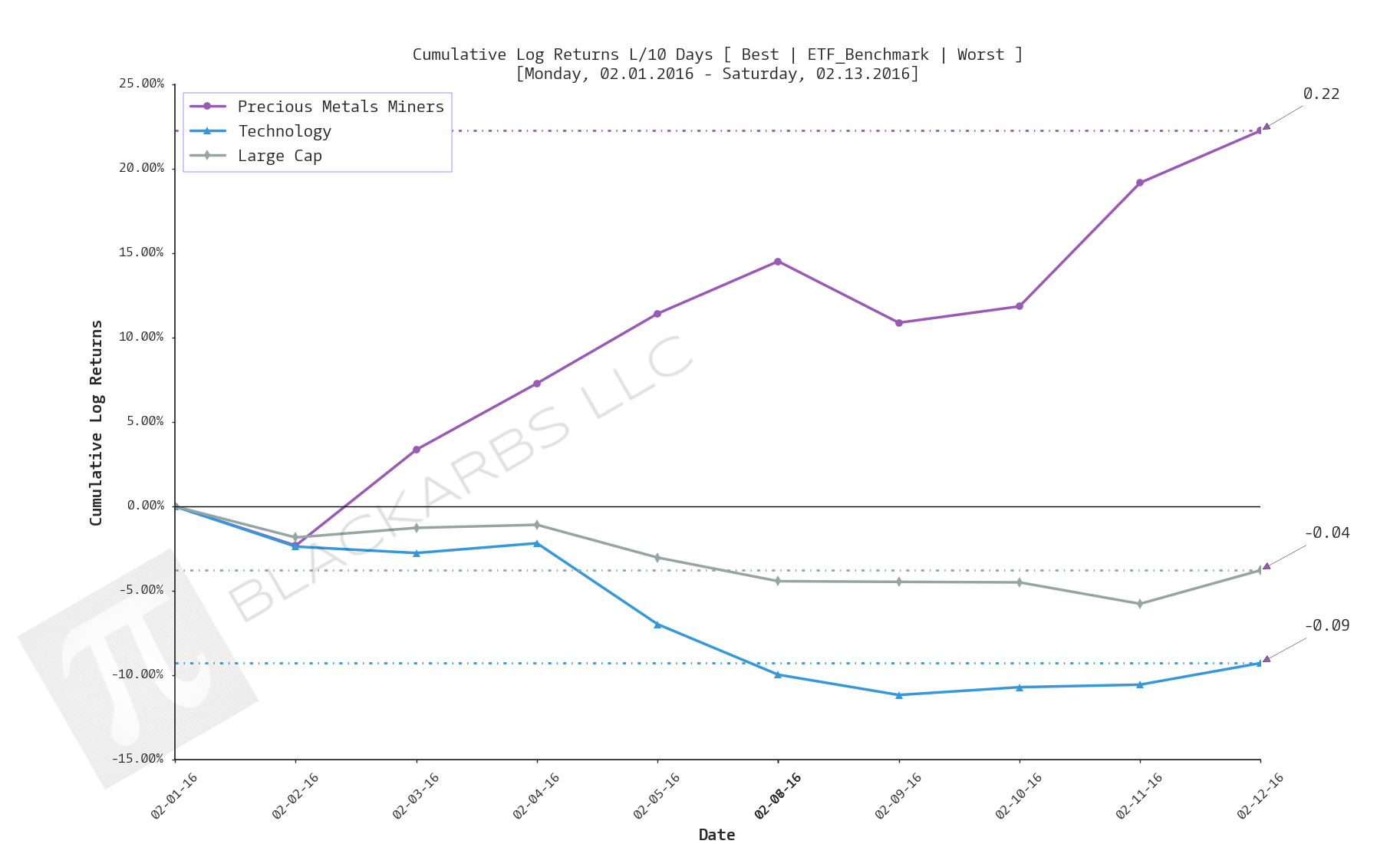

LAST 10 TRADING DAYS

Implied Cost of Capital Estimates:

To learn more about the Implied Cost of Capital see here.

CATEGORY AVERAGE ICC ESTIMATES

ALL ETF ICC ESTIMATES BY CATEGORY

Cumulative Return Tables:

Notable Observations and Trends:

- Investors appear to be increasing their defensive positioning in the market as evidenced by the continued relative strength in the Precious Metals/Precious Metals Miners and Treasury Bond composites.

- Investors appear to be liquidating previous high performing asset classes as evidenced by Healthcare being among the bottom 3 performers off all composites across 5/6 timeframes beginning over the last 126 days.

- This is also supported by further deterioration in the relative performance of the Technology composite, which appears as a bottom 3 performer year-to-date.

- Correlations still appear relatively binary. However, a notable change is occurring in the correlation of Oil and Gas with the rest of the Sector based composites. It appears to be weakening year-to-date as compared to the last 126/252 trading days.

- The Treasury bond composite is seeing a notable increase in its negative correlation with the rest of the market as well. I look for this trend to continue as long as the global Negative-Interest Rate Policy trend continues. The US offers relatively high yield when compared to negative rates!