COMPOSITE MACRO ETF WEEKLY ANALYTICS (5/14/2016)

/FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot (best vs worst vs benchmark)

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

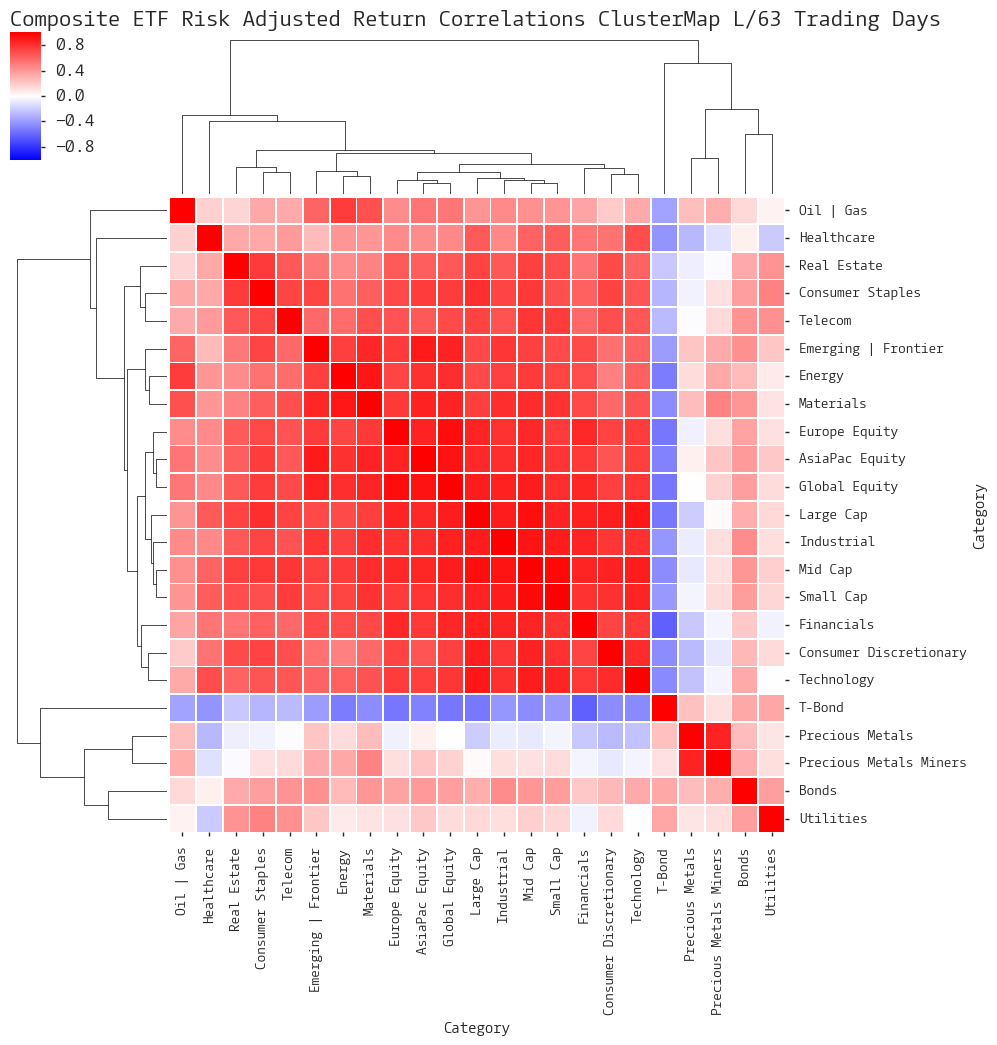

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Implied Cost of Capital Estimates

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

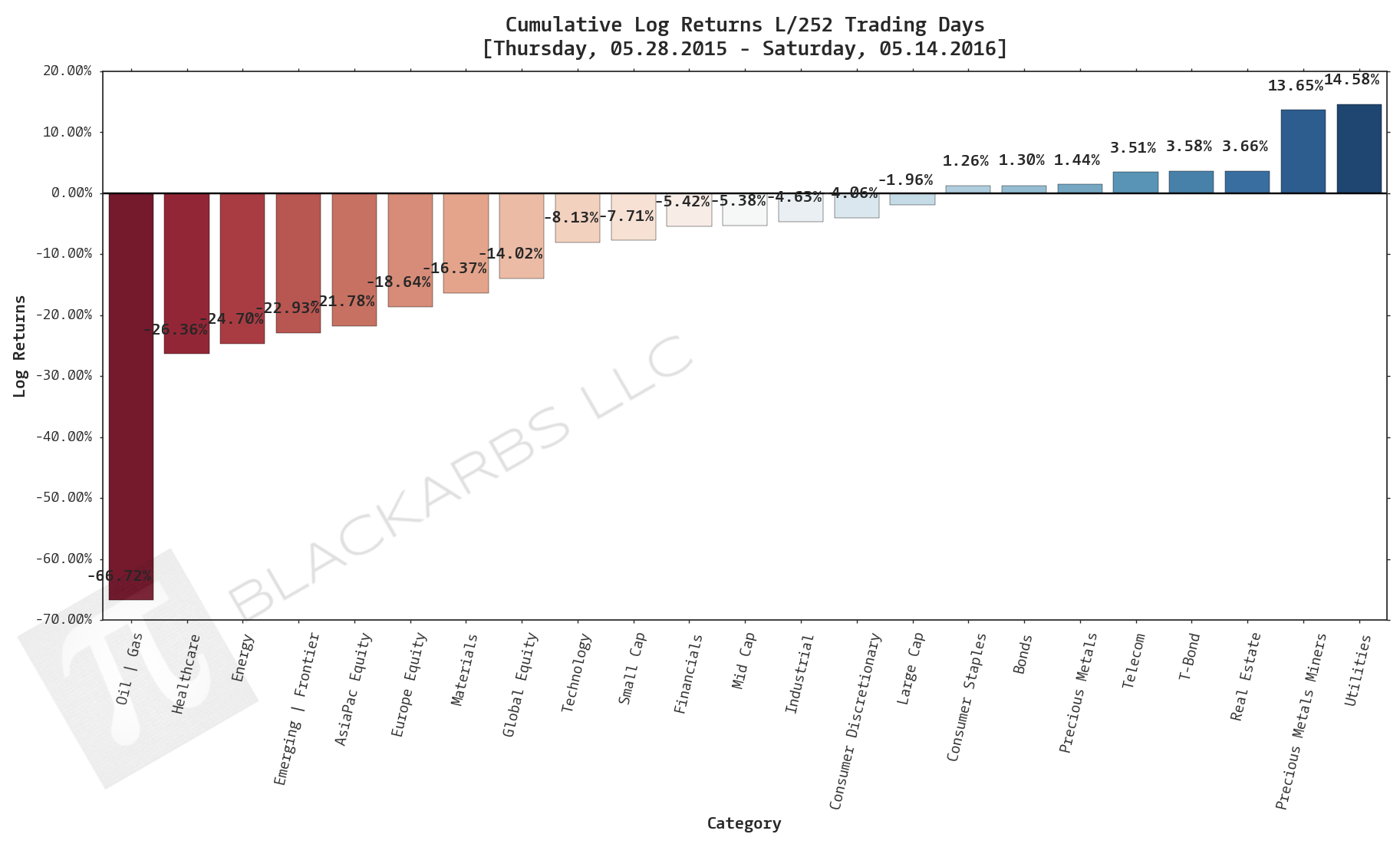

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

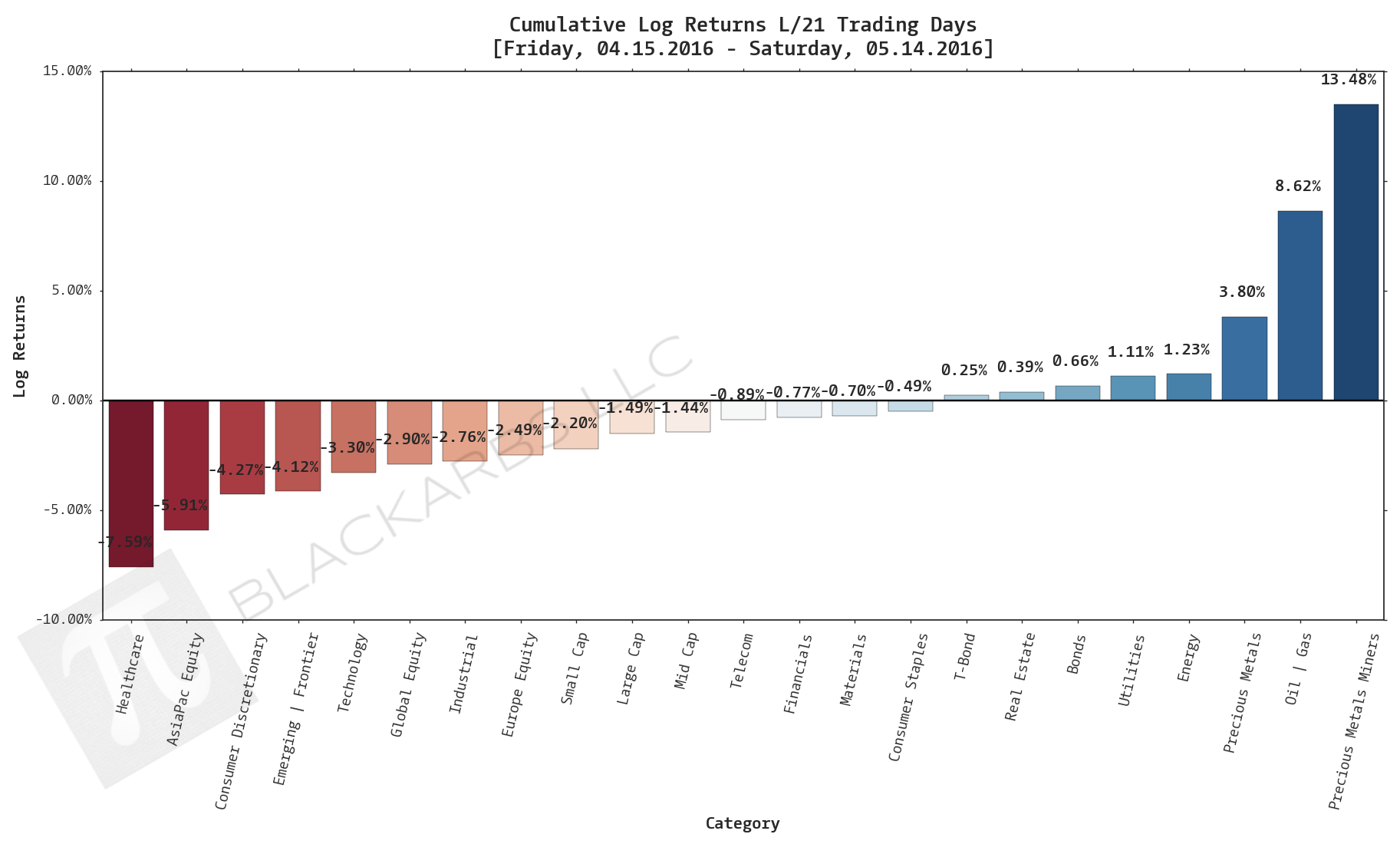

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Implied Cost of Capital Estimates:

To learn more about the Implied Cost of Capital see here.

ALL ETF ICC ESTIMATES BY CATEGORY

CATEGORY AVERAGE ICC ESTIMATES

CUMULATIVE RETURN TABLES:

NOTABLE OBSERVATIONS AND TRENDS:

- The healthcare composite has been a bottom 3 performer across all time frames.

- The Oil+Gas composite has been strong recently as a top 3 performer L/63, L/21, and L/10 days.

- The Large Cap composite is essentially unchanged over the L/252 and L/126 days.

- PMM has continued to outperform. The long gold and gold producers trade has been the trade of the year.

- PMM is up 60% (log returns) over L/126 days!

- An anecdotal observation: When every composite is all positive(negative) returns over the L/63 days or less, there has been a tendency for the markets to mean revert. Notice the return range compression for both best/worst performers over L/10 days. Seems like there is either a lack of catalysts or indecision among market participants.